The Pros and Cons of Short-Term Health Insurance Plans

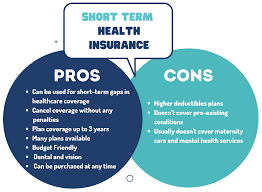

Short-term health insurance plans have grown in popularity, providing a temporary solution for those who need coverage but don’t qualify for traditional plans or are between jobs. While they can fill gaps, these plans come with advantages and disadvantages that are important to consider before making a decision.

What Are Short-Term Health Insurance Plans?

Short-term health insurance plans offer coverage for a limited period, usually up to 12 months, with the option to renew for an additional term. They are designed to provide a temporary safety net for people who may be transitioning between longer-term insurance options, such as when they are switching jobs or waiting for open enrollment in Marketplace health insurance 2025. These plans typically offer basic health coverage, but the extent of that coverage can vary.

Pros of Short-Term Health Insurance Plans

1. Affordability

One of the main attractions of short-term health insurance is that it’s often more affordable than traditional health insurance plans. Premiums are generally lower because the coverage is less comprehensive, which makes it a good option for individuals on a budget.

2. Flexibility

Short-term plans offer a great deal of flexibility. You can choose the length of coverage, and in some cases, you can cancel the plan without penalties. This makes it ideal for people who need temporary coverage without long-term commitments.

3. Fast Enrollment

Unlike traditional health insurance, which may have limited enrollment periods, you can sign up for short-term plans at any time during the year. This means you can get coverage quickly, without having to wait for open enrollment.

4. Customizable Coverage

You can select plans based on your specific needs, whether you only need coverage for emergencies or want to include doctor visits. This allows you to tailor the plan to suit your situation without paying for services you don’t need.

Read Also: Vital Fit Track Reviews: Smart Fitness Tracker for Health Enthusiasts

Cons of Short-Term Health Insurance Plans

1. Limited Coverage

The biggest drawback of short-term plans is their limited coverage. These plans often don’t include essential health benefits like maternity care, mental health services, or prescription drugs. They are intended to be a stopgap solution and not a replacement for comprehensive insurance.

2. Pre-existing Conditions

Most short-term plans do not cover pre-existing conditions. If you have a medical condition that requires ongoing care, you may find yourself paying out-of-pocket for treatment. This is a significant downside for those with chronic health issues.

3. No Protection Against Penalties

If you are using a short-term plan instead of a traditional health insurance policy, you may be subject to penalties if you don’t meet the minimum essential coverage requirements in some states. This can add to your overall healthcare costs in the long run.

4. Risk of Gaps in Coverage

While short-term plans can be renewed, there is a risk of gaps in coverage if you are unable to renew or if the plan’s terms change. This can leave you uninsured at critical moments, which is particularly risky if you develop health issues while on the plan.

When to Consider Short-Term Health Insurance

Short-term health insurance may be worth considering if you are in a transitional period, such as between jobs, waiting for coverage to begin with a new employer, or outside the open enrollment period for more comprehensive plans. However, it’s crucial to weigh the pros and cons based on your health needs, financial situation, and the likelihood of needing extensive medical care.

In conclusion

Short-term health insurance plans can serve as a temporary solution, but they are not a substitute for comprehensive health insurance. It’s essential to assess your health needs carefully before deciding if a short-term plan is right for you.